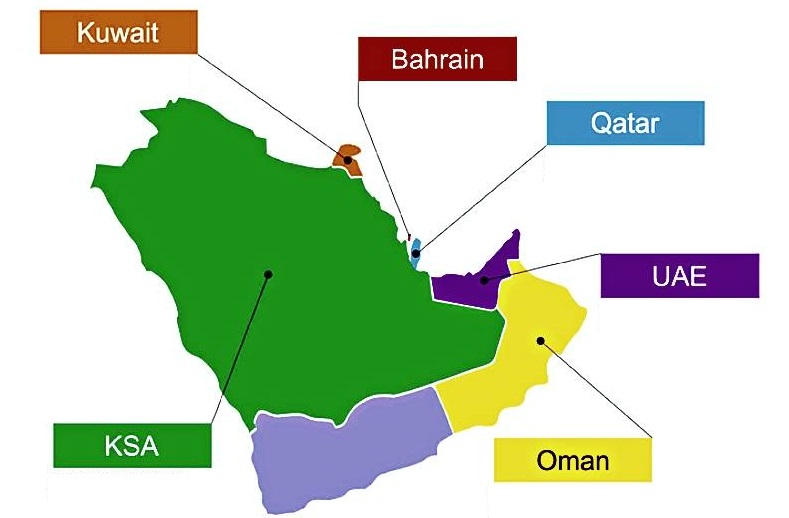

The Gulf Cooperation Council (GCC) is undergoing a transformative fiscal shift, marking the region's most significant economic change since its inception. Once known for its zero-tax regimes that attracted global corporations, the GCC is now embracing a new era of transparency and fair taxation under global initiatives.

A global minimum corporate tax rate of 15%, spearheaded by the OECD and adopted by over 140 nations, is reshaping the tax landscape. This measure aims to curb profit-shifting practices by mandating that multinational enterprises (MNEs) with global revenues exceeding EUR 750 million over two of the last four years adhere to a minimum tax rate, regardless of their operational location.

For instance, corporations operating across London, Dubai, and Manama can no longer exploit low-tax jurisdictions to reduce their overall tax liabilities. This shift enhances global transparency and accountability.

The UAE took the lead in June 2023 by introducing a 9% corporate tax for businesses with profits exceeding AED 375,000 while maintaining incentives such as SME exemptions for turnovers under AED 3 million and free zone relief at 0% tax rates. These measures balance compliance with global standards while safeguarding the UAE's competitive edge as a business hub.

Other GCC nations are following suit:

The phased implementation of Value Added Tax (VAT) since 2018 has also gained traction, with Bahrain and Saudi Arabia increasing their rates to 10% and 15%, respectively.

Evidence suggests that well-structured tax systems boost economic growth by fostering employment, encouraging business expansion, and attracting investments. Additional revenues are funneled into critical infrastructure and public services.

The GCC’s zero personal income tax policy remains a competitive advantage, especially for high earners, setting the region apart from hubs where personal tax rates exceed 20%. This approach continues to draw global talent.

Digital innovation is another cornerstone of this transformation. Saudi Arabia’s shift to e-invoicing has set the stage, with the UAE set to mandate e-invoicing for B2B and B2G transactions by 2026. This initiative reduces fraud, enhances transparency, and modernises business practices, benefiting both SMEs and larger corporations.

Although businesses may experience short-term impacts on profitability, the GCC’s overarching vision is clear: creating a diversified, resilient, and technologically advanced economy that attracts quality investments and talent. The integration of corporate taxes, global minimum tax laws, and digital tax administration solidifies the GCC's position as a global economic powerhouse.

This fiscal revolution represents not just a shift in taxation but a commitment to building a transparent, efficient, and globally competitive ecosystem.